|VAT Refund?

Yes. Value Added Tax is VAT. When you put the word “refund” after VAT, means that there is a returned money or value. Many tourist know how to deal with VAT refund procedure but if you don’t I can tell you how to get it.

When you are traveling to Europe, Asia or North America or any country that you’re not their citizen, you can claim VAT refund.

Ask the store first!

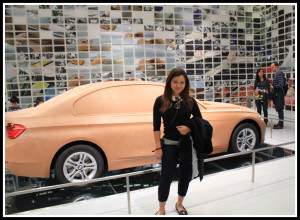

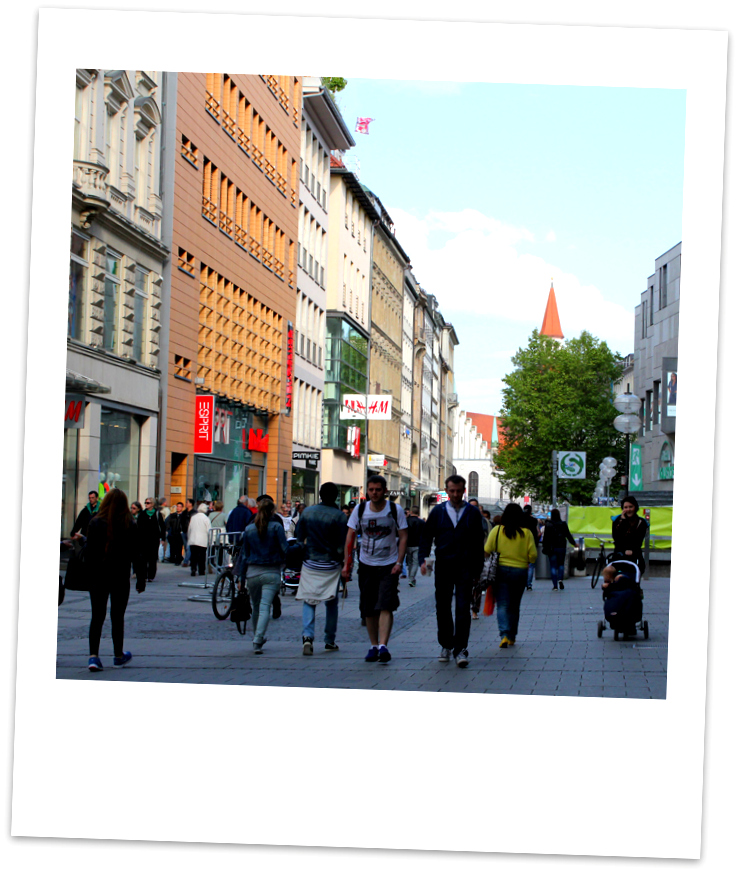

Each store in different countries has its own policy about VAT refund. For example, H&M in Paris only allows VAT refund when you purchase items at minimum of 175 Euros of your total receipt. You can shop 3 different times in H&M but the total amount of 175 Euros has to be on the same day. Combine all receipts and they will work on the TAX form.

What if you go to Paris and fall in love with a Louis Vuitton bags? Very simple.

1. Shop the bag and pay for it. I recommend using a credit card, Visa, Master and Amex.

2. The price on the bag is what you’re paying for. Let’s say their Mini Pochette is 204 Euros. You will be charged for 204 Euros.

3. When you are paying for this item, LV staff will kindly ask you if you would like to claim for TAX or VAT refund (same thing). You will say Yes please. Then get your passport out.

4. LV staff will fill out the form for you according to your passport. Name and Passport number are recorded on to your Tax form at this point. LV is affiliated with Global Blue, the company who will handle your money return.

5. LV staff will hand you the Tax form. It is blue fonts on a white paper. You will fill out your name and address, etc. They will ask you if you want your refund money in Cash or back to you credit card. If you choose to have it back to you card, then show them which card it is.

6. Once everything is done. LV staff will hand you the receipt (LV receipt) and the tax claim form. You will walk out of the store with 2 very important pieces of documents, if you lose one of them, then you can’t really claim your tax.

Unless you lost your LV receipt and they can reprint it for you. Do not lose your Tax claim form though.

7. When you are leaving Europe, it doesn’t matter what country it is, Italy, Germany or Spain. Make sure you have that very important papers in your hand. Keep your item that you bought in Paris in your hand.

8. At the airport, go to Customs office first! Do not check in your bag unless you only buy one item and it will go in to your carry on bag.

9. At the Customs, they will ask to see your receipt, your Tax claim form. They

will ask you to show the item that you purchased. Show them what they want to see. If you bought 10 items, it will be a random pick. I had to show one item out of 6 items.

10. The Customs will then stamp your Tax Claim paper (that has Global Blue on it). If you don’t have this stamp, you can’t claim tax.

11. Then you will grab everything, your receipt, your Tax form, your purchased item, to Global Blue counter.

12. Hand the stamped Tax form to the staff at the Global blue and keep your LV receipt. Global Blue has a receipt for your record, do not lose this one either. Right here, they will ask for your credit card that you want your money refunded to

.

13. The staff will put all required paper works into an envelope and put it in the mail for you!! I was very surprised when she said “I’ll mail everything out”. It was great, short and simple. I did not have to mail a thing!

14. At this point, you can put all purchased items into your checked-in luggage. I carried mine. I don’t want an unexpected delayed/lost luggage at the destination.

15. Wait for your money back 4-6 weeks. I got mine back within 4 weeks.

How Much will I get my money back?

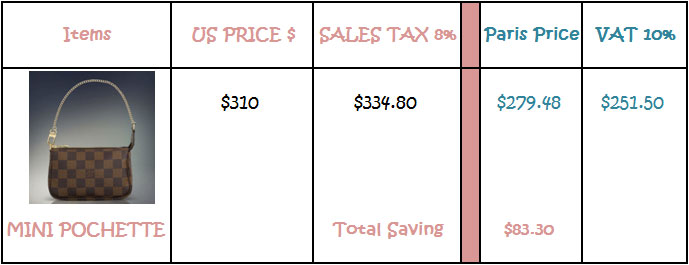

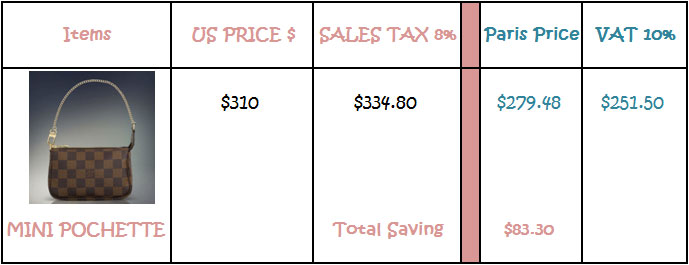

It depends on where you bought your item. In this sample, I got my mini pochette in Paris. After I got my tax refunded, it came down to 10%. So, I paid 10% less on items that are already cheaper than the US prices.

If you decide to have it in cash refund, you will either get 10% or 12%, it doesn’t have a rigid number. I asked Global Blue on the day of departure Europe, they said “it’s not necessary that cash percentage is lower than credit card’s”.

I had my refund back to my credit card. It is 10% and it is not bad. I saved over $840 of the total price.

The form on your left is what you will get inside the stores. You will fill out your name, phone number and mailing address. The very bottom piece is for you to keep. There is an estimate value of what you will receive for your VAT refund.

Keep this piece with you for your record. In case of missing claims or you have not gotten your money back, you will have to show proves of purchase.

Global Blue is a very well known company and is affiliated with many commercial stores. You will get a quick service at the airport if you have your documents ready, your items that your claim tax on ready, and your passport. When you stay in line at the Global Blue, make sure that you have these ready on hand. Get your credit cards that you want your money refunded to ready, Global Blue will have to get the card number in order to get your money transfer to it.

When I reached the window at the Global Blue, the staff first notified me that LV charges $1 (or a Euro, can’t remember) for this tax claim fee. I said “OK” without asking her to repeat it. Everything that costs $1 or a Euro is fine by me.

The price comparison in this table is based on $1.37 = 1 Euro.

If you take a look at my price sheet above, you’ll see how much cheaper a pochette already is in Paris, before the VAT refund. I think it is worth the trip to get what you want and it is worth the extra time to fill out the form for your money back.

Where is VAT refund office at the airport?

Global Blue counter in an airport

You will have to find it yourself. Search the airport website, there usually is a sitemap and it will tell you where it is. The easiest way is to ask any staff at the airport where the Customs is and the the customs’ staff will tell you where Global Blue is. I’m not affiliated with Global Blue, I use this as my sample because I bought my mini Pochette at LV and they affiliated with Global Blue. This picture below is what the Global Blue office usually looks like, only it is more crowded with a long line. Spare an extra hour at the airport if your flight is a prime time flight like lunch time or dinner time etc. The earlier you get there, the better chance you will get everything figured out way before your check-in time.

Customs & Global Blue in Amsterdam Airport

I departed Europe through Amsterdam Schipol Airport. When you arrive at the airport, facing the departure terminal, you’ll look for Departure 3. It is almost at the end of the terminal building. You’ll see the customs Tax free office then immediately to your right is Global Blue. If you walk pass this customs tax free, you’ll see check in counters. But I don’t think you can miss the Customs Tax free. It is in your face and the line gives away the obvious.

If you buy items affiliated with Premier TaxFree, you will have to take an elevator downstairs. It is very easy to find this Premier TaxFree as well.

Global blue is right next to Customs

Customs counter inside Schiphol Airport

Items worth stay in line for VAT refund

Fragrance, Makeup, Skin care products, Clothing, leather goods and many more. You cannot claim your hotel charge and meal. If you have an extra room in your check-in luggage and you won’t come back to Europe in two years, then go ahead and buy them because they are cheaper and worth the running around.

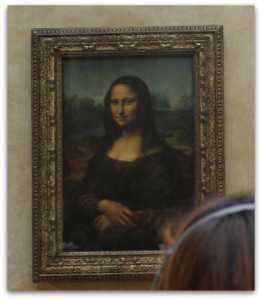

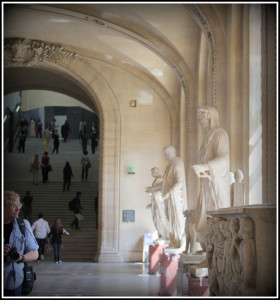

Europe has more to offer than just shopping, I hope you find you what you’re looking for in stores and also have time to enjoy yourself checking out European museums and history.

Good to know: Chanel is not affiliated with Global Blue but the procedure is pretty much the same. I only bought one item from Chanel and the refund time takes longer than Global Blue. If you have any question please leave comments below. I’ll be glad to help you out.

Update Premier TaxFree: Chanel is affiliated with Premier TaxFree and I just got a refund to my credit card at $1.34 per 1 Euro. {June 2014}

Match your favorite brand with their affiliate

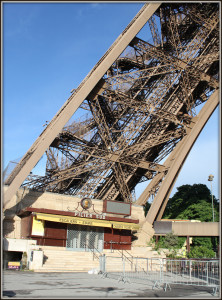

My version of Eiffel tower is a bit different than others that it has a huge tennis ball hung right in the middle. Yep, there were people working on getting that round ball up there. It was supper nice and quiet at 8:00AM here in the park too. People were jogging and heading to work.

My version of Eiffel tower is a bit different than others that it has a huge tennis ball hung right in the middle. Yep, there were people working on getting that round ball up there. It was supper nice and quiet at 8:00AM here in the park too. People were jogging and heading to work.

I started off my trip to Paris from Cologne, Germany. I booked a 3 hours train ride, Thalys. It was a “first class” section of the train. Thalys has become European dependent train going across Europe in the countries like German, France, the Netherlands and Austria. I enjoyed the train as much as the food! It was breakfast time when I left Cologne. I started my first croissant in Munich and this is going to my second one.

I started off my trip to Paris from Cologne, Germany. I booked a 3 hours train ride, Thalys. It was a “first class” section of the train. Thalys has become European dependent train going across Europe in the countries like German, France, the Netherlands and Austria. I enjoyed the train as much as the food! It was breakfast time when I left Cologne. I started my first croissant in Munich and this is going to my second one.

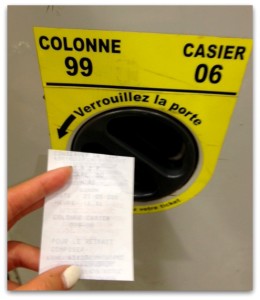

The code on the receipt is the code to unlock it when you need to open your locker.

The code on the receipt is the code to unlock it when you need to open your locker.

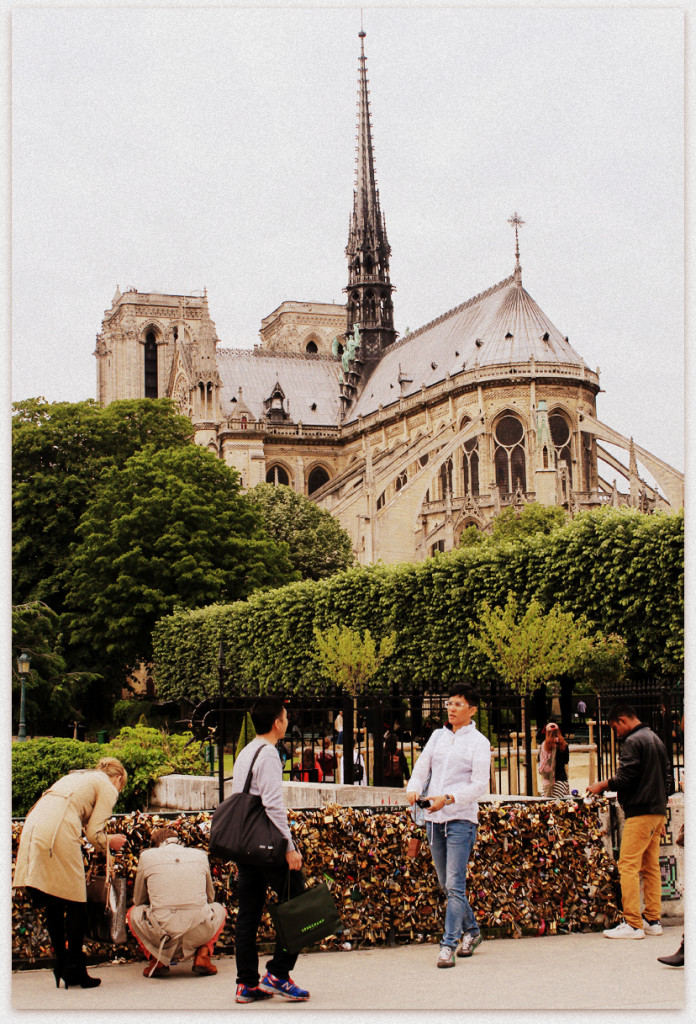

It is a lot of love on the bridge. Imagined if only the sky was blue. I turned around and looked back at the cathedral once more. Taking it in at this point.

It is a lot of love on the bridge. Imagined if only the sky was blue. I turned around and looked back at the cathedral once more. Taking it in at this point.

.

.

caffeine and sweetness. Not too much like our Starbucks and not too mild like when I did it myself. What an enjoyable cup of coffee.

caffeine and sweetness. Not too much like our Starbucks and not too mild like when I did it myself. What an enjoyable cup of coffee.

When you order a cup of tea, you will get a tea biscuit. It comes with no extra charge.

When you order a cup of tea, you will get a tea biscuit. It comes with no extra charge.

Recent Comments